child tax credit 2021 eligibility

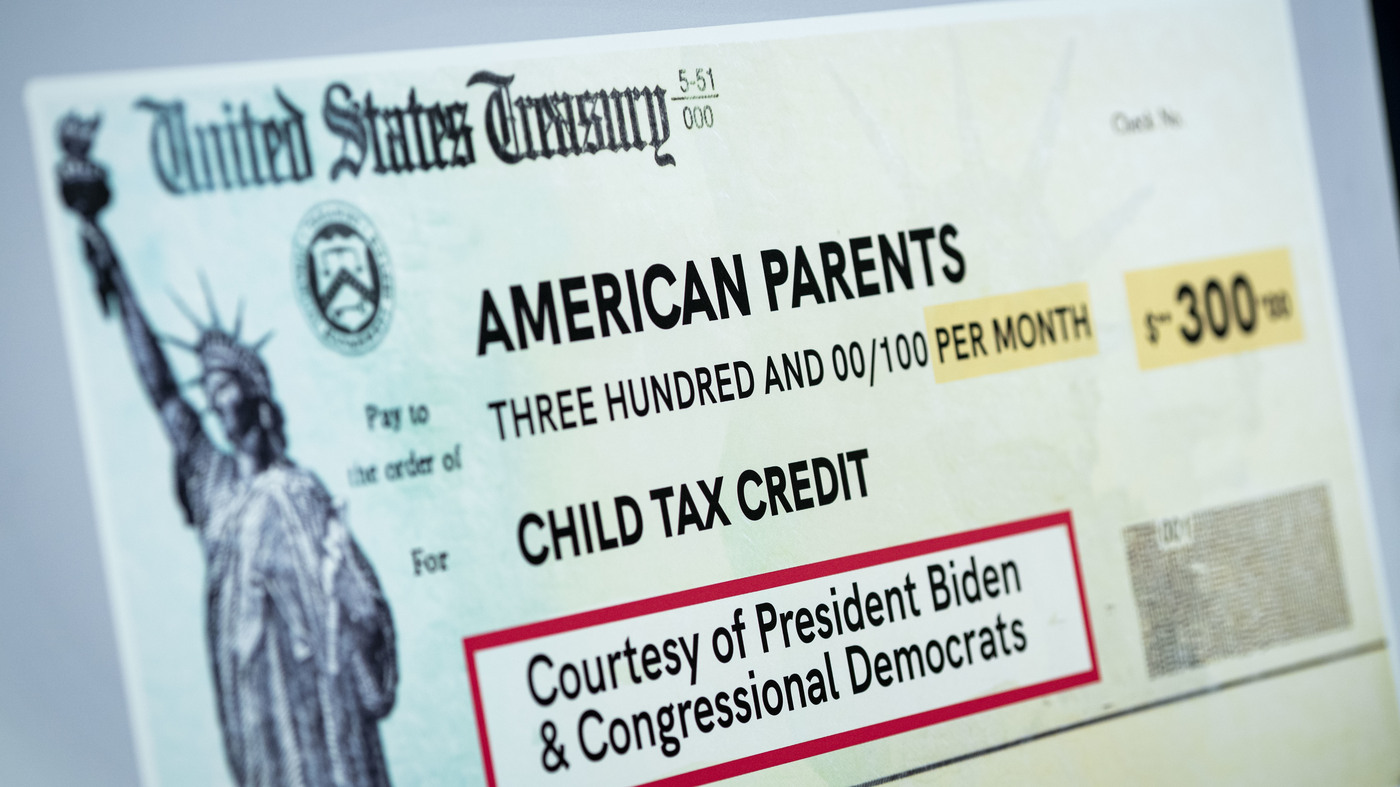

For each child under 18 theyll receive 250 per month. Half of the money -- up to 300 per month per child -- was distributed to eligible families who didnt opt out using the IRS Child Tax Credit Portal in 2021.

Additional Child Tax Credit Actc Overview How It Works Requirement

Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December.

. But if youre having a baby in 2021 you wont get the money until later. All children under 18 are eligible for the child tax credit. Child Tax Credit Update Portal to Close April 19.

The amount you can get depends on how many children youve got and whether youre. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that.

In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6. However not everyone has filed their tax returns. For the 2021 tax year parents got some extra help from the government in the form of an enhanced child tax credit that expanded eligibility for the credit along with the maximum amount people could receive.

Those who are eligible for the increased credit amount include. Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Married filing a joint return. For each child under 6 parents can receive 300 per month. The maximum Child Tax Credit payment was 3600 for each qualifying child up to age 5 and 3000 for each child age 6-17.

Meet the income requirements which are different depending on whether you have children and are filing taxes. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The remaining half of the credit for e ligible may be claim ed when the advanced payments are reconciled with the total eligible Child Tax Credit on the 2021 income tax return.

The 500 nonrefundable Credit for Other Dependents amount has not changed. Have a valid Social Security number. Who Is Eligible for the Advance Child Tax Credit.

Children also must have a Social Security number SSN to qualify for the 2021 child tax credit. Have filed a 2019 or 2020 tax return. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income. This portal closes Tuesday April 19 at 1201 am. You need that information for your 2021 tax return.

Single or head of household or qualifying widow er 75000 or less. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Already claiming Child Tax Credit.

To be eligible you and your spouse if filing jointly must. The Child Tax Credit is reopening to help struggling families. The credit is not a loan.

Previously only children 16 and younger qualified. Have earned income through work during 2021. Find the total Child Tax Credit payments you received in your online account or in the Letter 6419 we mailed you.

Single taxpayers with incomes under. 3600 for children ages 5 and under at the end of 2021. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

In 2021 eligible families could claim 1800. The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older. 3000 for children ages 6 through 17 at the end of 2021.

Citizen or a resident alien for all of 2021. There are basic eligibility rules that apply to most everyone. To claim this tax credit a child will need to have lived with the parent in question for at least half the year with that parent having provided more than half of the corresponding financial support.

Not everyone is eligible for advance child tax credit payments. Half of the total amount came as six monthly payments so for each child up to age 5 you would have received six payments of up to 300 and for each child age 6-17 you would have received six monthly payments of up to 250. Most families with children 17 and.

Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. Ad The new advance Child Tax Credit is based on your previously filed tax return.

The IRS determines payment eligibility based on the applicants 2019 or 2020 tax returns. According to the irs those eligible to receive payments include an. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17.

The American Rescue Plan temporarily increases the child tax credit for the 2021 tax year. The advance is 50 of your child tax credit with the rest claimed on next years return. Generally to be eligible for the Earned Income Tax Credit you must.

As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. Before 2021 the credit was worth up to 2000 per eligible child and children 17 years and older were not eligible for the credit.

This is the first year that 17-year-olds qualify for the CTC the previous age limit was 16. This tends to especially be true for families. Be within the income limits.

Have child with a valid social security number who was under age 18 at the end of 2021. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

A qualifying child must be at least four but less than 17 years old on December 31st of the tax year and must qualify for the federal child tax credit. As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. Up to 8000 for two or more qualifying people who need care up from 2100 before 2021.

The credits scope has been expanded. Making a new claim for Child Tax Credit.

The Child Tax Credit Toolkit The White House

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Child Tax Credit Toolkit The White House

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit Schedule 8812 H R Block

Here S Who Will Benefit From The Expanded Child Tax Credit Marketplace

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Biden S 15 000 First Time Homebuyer Tax Credit Tax Credits Home Buying First Time

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep